Establishing leadership positions in IP networks, cloud, BSS/OSS, TV & media and IoT industry and society are central to Ericsson’s overall strategy, according to Rima Qureshi, chief strategy officer for Ericsson, who provided Jeff Mucci from RCR Wireless News with an update on Ericsson’s 2015 strategy, which was first presented last November in Stockholm at Ericsson’s Business Innovation Forum and more recently presented at Ericsson’s capital markets day.

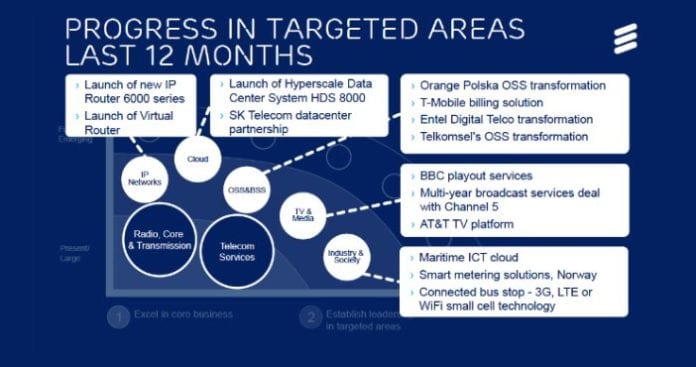

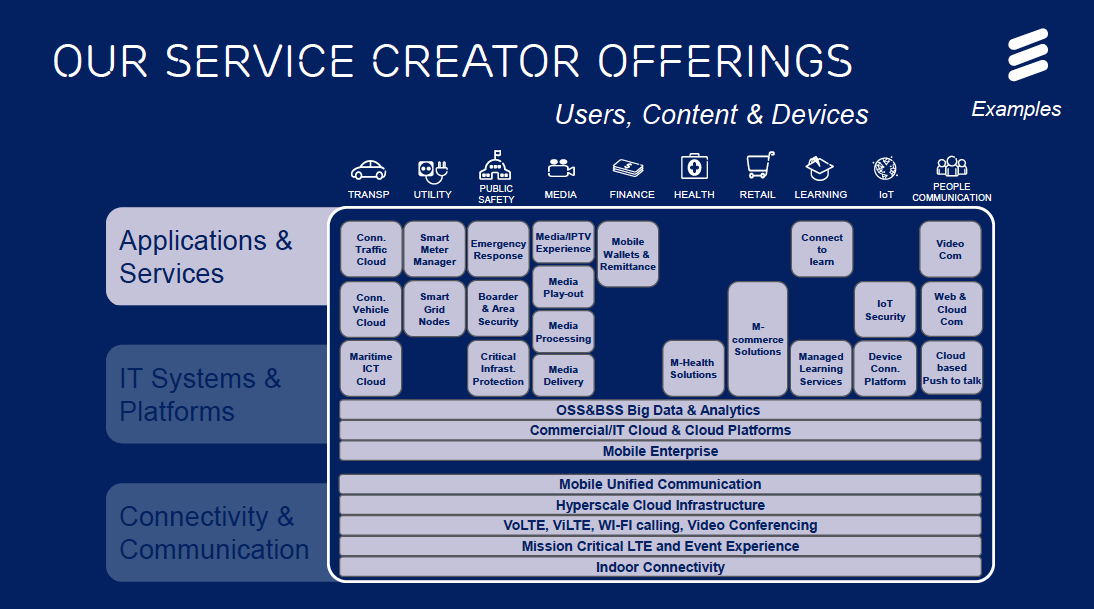

Ericsson’s 2015 strategy centers on the following areas:

- Excel in core business – radio, core, transmission and telecom services.

- Establish leadership in targeted areas – IP, cloud, business support systems/operating support systems, TV and media, industry and society.

- Expand business in new emerging areas.

Specific areas Ericsson is targeting for market leadership include:

- IP networks.

- Cloud to include network functions virtualization and software-defined networking.

- BSS/OSS.

- Media and TV.

- Industry and society.

Watch Jeff Mucci, RCR Wireless News CEO, interview Rima Qureshi, Ericsson chief strategy officer.

Updates on each of the targeted areas are outlined below:

- IP networks update

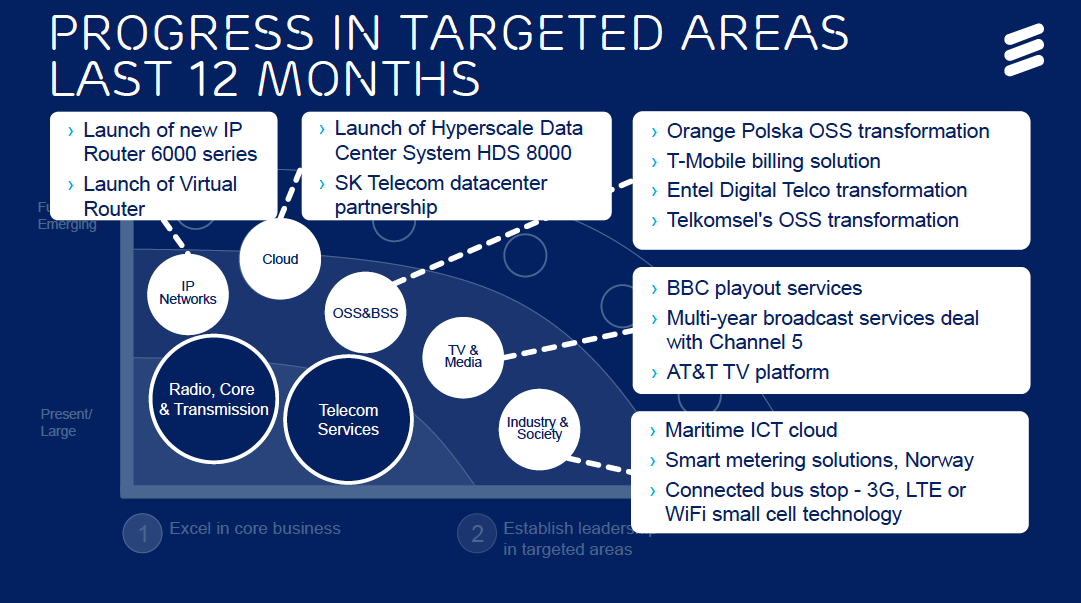

- Ericsson launched their own router 6000 series of products along with a virtual router product while formalizing a next generation strategic alliance with Cisco, whereby Ericsson will be reselling Cisco’s IP networking products to their installed base of customers while seeking to introduce their own radio access network and edge experience into Cisco’s IP network installed base of enterprise customers. The partnership provides a foundation for “5G” networks in the future.

- Cloud update

- At Mobile World Congress 2015, Ericsson expanded its Ericsson Cloud System with the launch of the Ericsson Hyperscale Datacenter System 8000, built on Intel Rack Scale Architecture, Ericsson Secure Cloud Storage and Ericsson Continuum capable of delivering a policy-driven platform for hybrid cloud. Starting with their installed base of customers, Ericsson’s objective is to help carriers virtualize network functions while helping them monetize the cloud with enterprise offerings. Carrier customers can buy the HDS 8000 for deployment in their own datacenter or utilize Ericsson’s cloud platform as a service.

- SK Telecom is evaluating the HDS 8000 platform while collaborating with Ericsson to develop their own enterprise offering.

- In 2014, Ericsson acquired a majority share of Apcera, the creator of Continuum, an IT platform-as-a-service that enables enterprises to securely and transparently control the allocation and consumption of IT resources on premise and in the cloud.

- Ericsson continued its partnership with Mirantis, an OpenStack production deployment software platform.

- Integrating Guardtime’s Keyless Signature Infrastructure big data security offering into Ericsson’s cloud offering.

- No plans to compete with AWS.

- BSS/OSS update

- Ericsson claims the No. 1 position in the BSS/OSS market segment.

- Updates over the past year include displacing Amdocs as part of a T-Mobile US billing solution upgrade.

- Ericsson’s objective is to help carriers look at converged, agile, digital transformed solutions that enable differentiation.

- BSS/OSS is one of the more mature targeted areas for Ericsson, however, a critical component to the overall IP network, cloud and IoT strategy.

- The biggest challenge for any operator is to make changes in days and hours without impacting existing network operations.

- TV and media update

- Ericsson recently announced that AT&T TV will be using Ericsson’s media room offering, which Ericsson acquired from Microsoft in Q3 2013, to integrate best-in-class DirecTV and U-verse technologies.

- BBC Playout extended their agreement with Ericsson.

- In the future, Ericsson said it will continue to invest in both hardware and software video compression technologies. For example, Ericsson acquired Envivio, a video processing and delivery company, for $125 million to enable their customers to deploy new technologies and agile video processing to innovate new services.

- Industry and society IoT update

- Ericsson released its annual mobility report, which estimates that there will be 27 billion connected devices by 2020.

- Ericsson announced earlier this year that Maersk had selected Ericsson’s Maritime ICT cloud solution to track hundreds of thousands of containers worldwide.

- Ericsson’s objective over the long-term is to drive efficiencies and adoption by leveraging horizontal platforms and services that clients can use across multiple vertical markets. For example, in Q3 2014, Ericsson expanded outside its traditional telecom roots into transport and utilities by acquiring MetraTech, a provider of metadata-based billing, commerce and settlement solutions.

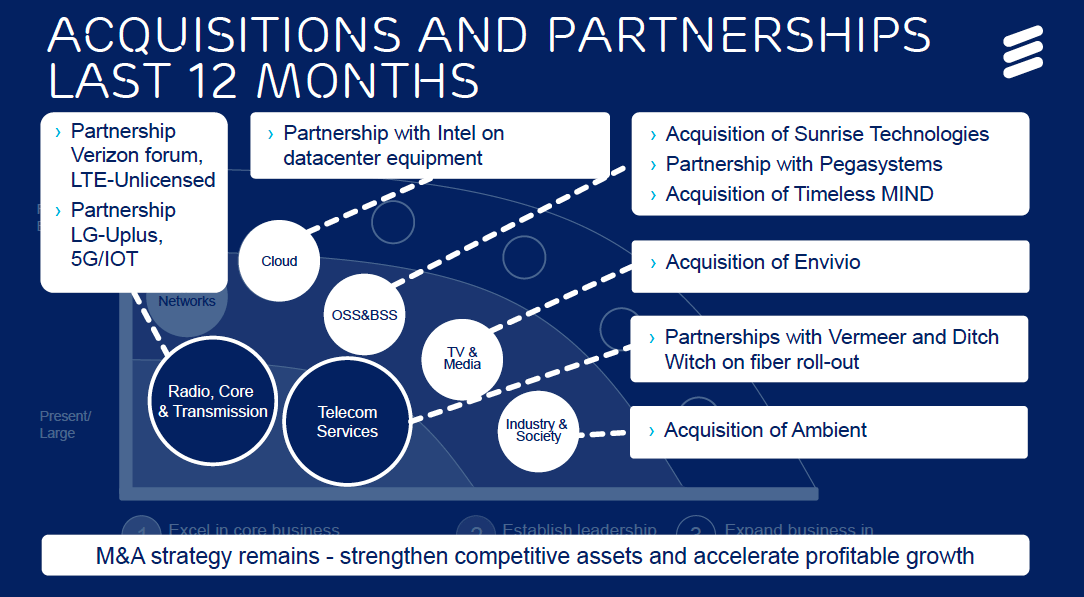

- The role of a carrier in the future will be dependent on the carrier’s strategy of being a network developer, service enabler or service creator. Per Qureshi, 40% of carriers are network developers, 40% are service enablers and 20% are service creators.