Defining unlimited; and T-Mobile US in the driver’s seat

Last week, the Federal Communications Commission voted 3-2 to fine AT&T Mobility $100 million for allegedly misleading customers about unlimited data plans. Despite many news outlets calling this the first of many “net neutrality fines,” the largest fine ever imposed by the FCC deals with one of the only surviving portions of the 2010 Open Internet Order called the Transparency Rule (section 8.3).

In this section, wireless carriers are required to “publicly disclose accurate information about their network management practices, performance and commercial terms of its broadband Internet access services sufficient for consumers to make informed choices regarding use of such services.”

The specific item in question is whether AT&T Mobility fully disclosed what the resulting reduced speeds would be when unlimited customers exceeded the 5 gigabyte (4G speed) or 3 GB (3G speed) cap. According to an article found here, the speeds went from between 5 and 12 megabits per second to 512 kilobits per second for 4G customers and from 1.7 to 6 Mbps to 256 kbps for everyone else. While AT&T Mobility did notify customers that their speeds would be reduced (including a nationwide press release, a front-page bill notice for all unlimited customers in 2011, text messages describing the policy to unlimited customers prior to being throttled and detailed information in several areas of AT&T’s website such as that found here), they did not notify customers of the resulting throttling level. The “transparency rule” clearly allows throttling, but requires disclosure of the new level.

AT&T is sure to appeal the fine and has already ended the practice of offering unlimited plans. One interesting side argument that is sure to be made by AT&T is whether information on the website acts as a disclosure mechanism, especially for those video-hungry customers who made up the top 3-5% of all data users during the 2011-2014 time period. Those who experienced throttling were not shy to write about it in 2011, as this Android Central article describes. In fact, Ars Technica did a full piece on specific carrier policies here in 2014, concluding that throttling “isn’t automatically a bad thing if it’s necessitated by limited bandwidth and done only when cell sites are so congested that heavy users would prevent lighter users from connecting at all.” For a broader legal synopsis of the case, take a look at this commonlawblog.com article here.

Last week, Sprint disclosed that it had changed its network policy (something we highlighted at the time it went into effect). Previously, only customers who were defined as the “top 5% of all data users” would see their Internet speeds slowed, and that would only occur if there was congestion at the specific cell site in question. Now, the policy is as follows (from Sprint’s website):

Allocating Resources During Times of Congestion: Despite its best efforts to prevent congestion through managing tonnage and directing customers to the best available network resources, the demand on a particular network sector sometimes temporarily exceeds the ability of that sector to meet the demand. During these times, Sprint relies on the radio scheduling software provided by Sprint’s hardware vendors to allocate resources to users. This radio scheduling software includes a set of generic fairness algorithms that allocate resources based on signal quality, number of users, and other metrics. These algorithms are active at all times, whether or not the cell is congested; however, during times of congestion, the algorithms operate with the goal of ensuring that no single user is deprived of access to the network.

Remember the term “generic fairness algorithm.” As the Ars Technica article points out, this has not prevented Sprint from limiting video speeds on their network to 600 kbps, although Sprint indicated that this policy is also undergoing changes.

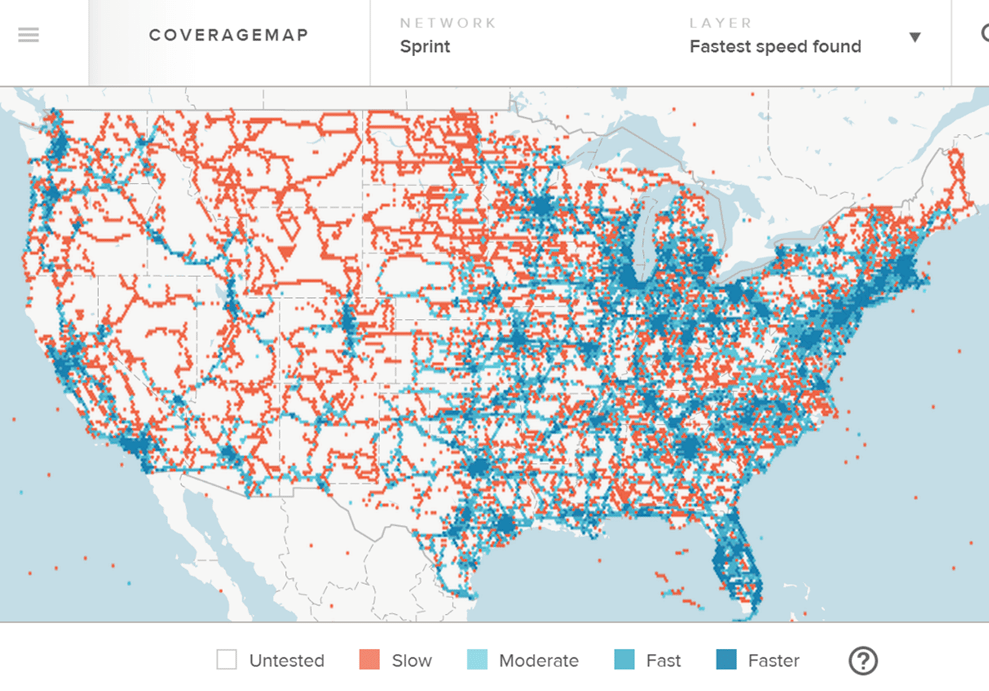

How this change to the network affects Sprint’s market share standing is not clear. Judging from recent speed tests, however (see chart for the latest RootMetrics assessment of Sprint’s data performance – more information for each carrier here), the role of algorithms, which presumes that there is enough provisioned spectrum and cell site backhaul for faster data speeds, may not play into the calculus in second- and third-tier markets (or the “in between” spaces along highways). Sprint’s network capacity, and not a specific network policy, is constraining its ability to deliver competitive speeds and video experiences.

This is just the beginning of the FCC’s role in determining what is – or, in the case of AT&T, should have been considered in 2011 and 2012 to be – “fair and reasonable” network management. Government scrutiny will do little to advance solutions to the complex issues surrounding the delivery of video services to mobile devices. Increased regulation will, however, force wireless and wireline carriers to clarify the meaning of unlimited, specifically that a higher speed experience may not continue forever.

Trend 3: T-Mobile US – in the driver’s seat

Last week, we discussed AT&T’s southern shift into Mexico and cable/telco/satellite consolidation as a mechanism to increase bargaining strength when renegotiating content and retransmission agreements. These trends will undoubtedly remain throughout the rest of 2015 and into 2016.

The next important trend is the continued momentum that T-Mobile US has experienced in 2015. It’s hard to believe that there was a time when T-Mobile US was a distant fourth-place wireless provider, but that statement could have been made as late as 2012, when John Legere took the helm of its U.S. operation. One of my favorite articles of all time is this rant by a T-Mobile US employee, which appeared in Phone Arena in March 2012. If that employee is still at T-Mobile US, I think he or she would have to agree that three years has produced a lot of changes at the company.

As we have described over several columns, T-Mobile US has a lot of things going for it:

1. It is spending its marketing dollars on attracting the most valuable smartphone customers. In a perfect world with unlimited capital, it would be raking in even more tablet customers, but have chosen to focus on smartphone customer acquisition.

2. It has begun to address the business market space. This will be the first full quarter of results for the carrier’s Simple Choice for Business plans. T-Mobile US took a slightly different stance from its competitors, choosing to focus on competitive rates for traditional wireless services as opposed to offering software and communications services bundles. It will be interesting to see how successful the initial plans have been, including the extension of business lines to count as the first line in any individual family plan, and what adoption they have seen to date in local markets where T-Mobile US’ data coverage is strong.

3. It has broadened its LTE coverage – 275 million potential customers covered as of Q1 2015 – and distribution over the past several quarters. Increased coverage has a twofold effect. First, it opens up new retail distribution opportunities to markets that have not seen T-Mobile US’ new LTE network. Second, it opens up Wal-Mart/Tracfone as a distributor for Straight Talk-branded products and services.

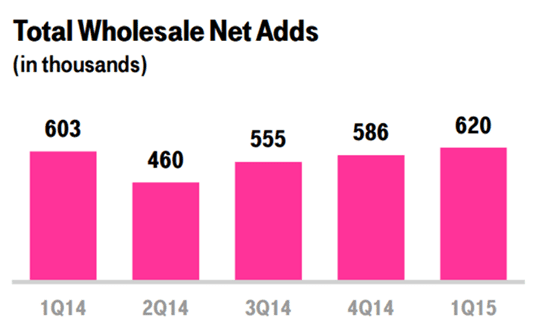

4. It has stuck to an aggressive wholesale strategy. T-Mobile US’ continued cultivation of a strong wholesale environment stands in contrast to both of its larger competitive providers (see trends from their most recent earnings release). As T-Mobile US brings churn under control on the retail side, wholesale data volumes will continue to provide cash flow to underserved segments.

If current trends hold, there’s no doubt that T-Mobile US will be widely considered the third-largest wireless provider after second-quarter results are posted. It is the belle of the ball, has 700 MHz capacity deployments remaining that will drive further market share gain and is well positioned in segments and locations where local data performance and service reliability will be critical to market share gains. It’s also very likely that T-Mobile US will show increased profitability as a result of where it is in its customers’ life cycle – most customers have converted to Simple Choice plans.

What T-Mobile US’ German parent decides to do with its U.S. subsidiary has generated recent press. It’s important to note that its current balance sheet could accommodate several billion dollars of additional debt without significantly compromising its integrity. This “grow alone” course needs to be weighed against potential alternatives. Regardless, T-Mobile US’ value is considerably stronger than anyone would have anticipated three years ago. It is clearly in the driver’s seat.

Next week, we’ll touch on a couple more industry trends before taking a break for the July 4 holiday.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at [email protected] and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.