T-Mobile US’ ‘Un-carrier 9.0’ set to disrupt enterprise market

Throughout the course of telecommunications history, the pricing alchemy between business and consumer plans has been convoluted at best, and perverted at worst. This started with landline – voice – pricing in the previous century, and continues today with wireless and broadband rates. Individuals communicating/browsing/messaging over the same iPhone/Android and surfing the same website pay more, on average, through their business than if they had purchased a consumer plan and been reimbursed.

For example, through Sprint, consumers can receive 4 gigabytes of shared data with unlimited talk and text for each line for $140 (or $130 with the 8 GB promotion currently offered). If those four data sharers are actually four employees in a business, that rate jumps to $160 (see here for rate cards). There may be an occasional exception to this rule but, in general, business customers pay more for the same services than consumers.

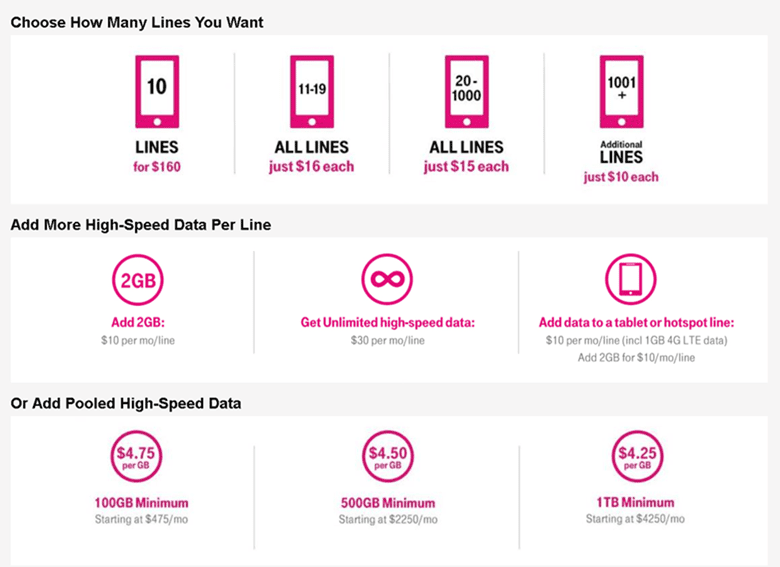

T-Mobile US’ announcement changes that equation significantly. For $160, businesses receive 10 lines of service with unlimited talk and text and each line receives 1 GB of data. For those who do not follow T-Mobile US’ pricing structure, this is a less expensive version of their four lines for $100 family plan. Employees who use higher amounts of data can upgrade to an unlimited plan for an additional $30 per month. Also, as shown above, businesses can pool data starting at $475 per month for 100 GB (note: while Sprint’s 100 GB pooled data rate is 30% cheaper at $330, their $35 line fee for unlimited talk and text results in a higher overall price than T-Mobile US for a 10-line business).

What’s most interesting about T-Mobile US’ pricing structure is that it is attractive to lower – 1 GB per month – data users. This makes sense, as business Web browsing, picture sharing and e-mail access should result in less data usage than Netflix-hungry consumers. How T-Mobile US competitively positions their baseline offer, however, will be critical to their success.

The real kicker of the T-Mobile US plan, however, is the linkage it has created between business and consumer plans. Every business wireless subscriber to the plans described above counts as the first line in a corresponding T-Mobile US family plan. That linkage is the real disruption in this announcement. For example, if mom has a business line through work, the remaining three family members would be priced at $30, $10, and $10 per month. The same data upgrades per line would apply – $10 to 3 GB, $20 to 5 GB, $30 to unlimited. This has an obvious affect on acquisition revenue in consumer plans if the employee plans are successful. T-Mobile US did not explain how current subscribers could convert into this new plan so the affect on existing average revenue per user is not known.

Bottom line: T-Mobile US’ new business plans are going to be very effective, not only for businesses, but for their employees. Given renewal cycles, the effect on quarterly gross and net additions will likely be steady (as opposed to sudden). The depth of “Un-carrier 9.0” will directly depend on their distribution strategy.

Will Showtime, HBO and others get fast lanes?

In this week’s The Wall Street Journal, an interesting article appeared detailing negotiations that have been occurring among several video-streaming service providers (including Apple, HBO, Cinemax, Sony) and broadband providers (including Comcast).

Specifically cited in the article is the theory that each of these over-the-top services could be classified as a “managed service.” Julius Genachowski, who preceded Tom Wheeler as Federal Communications Commission chairman, described his view of managed services as follows in a 2009 Brookings Institution speech:

“I also recognize that there may be benefits to innovation and investment of broadband providers offering managed services in limited circumstances. These services are different than traditional broadband Internet access, and some have argued they should be analyzed under a different framework. I believe such services can supplement – but must not supplant – free and open Internet access, and that we must ensure that ample bandwidth exists for all Internet users and innovators. In the rule making process I will discuss in a moment, we will carefully consider how to approach the question of managed services in a way that maximizes the innovation and investment necessary for a robust and thriving Internet.”

The Journal – and subsequent news publications who did follow-up stories on the topic – did not go into the details of a possible agreement, but describe that managed services could be a component of a larger and more complex deal, which may or may not involve revenue sharing between broadband providers and video streaming companies. What is clear is that data consumed through these services would not be included in any caps (which we cited as an inevitable outcome in a previous column).

Needless to say, this article left many net neutrality advocates confused and upset. If paid prioritization was a bright line topic, how could Apple, Sony and HBO get special treatment? One possible answer: According to reports, Comcast will make any managed service offering equally available to any company, so pricing could be transparent and “special treatment” wouldn’t be that special.

As of this past Sunday, the FCC has yet to comment on this report or provide greater definition of managed services, but the Open Order clearly outlines that there will be a review of all bandwidth management processes. How they rule on this matter could determine the future of streaming video.

New York punts (again) on the Comcast/Time Warner Cable merger

A few weeks back, we penned an article proffering that if California could not kill the Comcast/Time Warner merger, New York would certainly take a swing. (Note: While Comcast has a small amount of customers in New York today, nearly 9% of the combined company’s customers would reside in the Empire state).

Everyone was hoping that some type of resolution would come in the March 18 Public Service Commission meeting (the fourth rescheduled ruling date). The Albany Times-Union reported that the commission had come up with specific “benefits” totaling $300 million. However, the PSC decided to punt their decision to the April 20 meeting.

As we mentioned in a previous column, April is a critical month for the Comcast/Time Warner Cable merger. The Open Internet Order is behind the FCC (except for Comcast’s inevitable court challenge), the Department of Justice should soon have a new Attorney General and April will mark 14 months since the merger was originally announced. Something’s got to give.

For some of the “benefit” ideas that were offered to the PSC, click here for Ars Technica’s article on New York City’s public advocate Letitia James. Her ideas make California’s merger conditions almost look reasonable.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at [email protected] and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.