Customer accounting practices at center of potential T-Mobile US/Sprint place swap

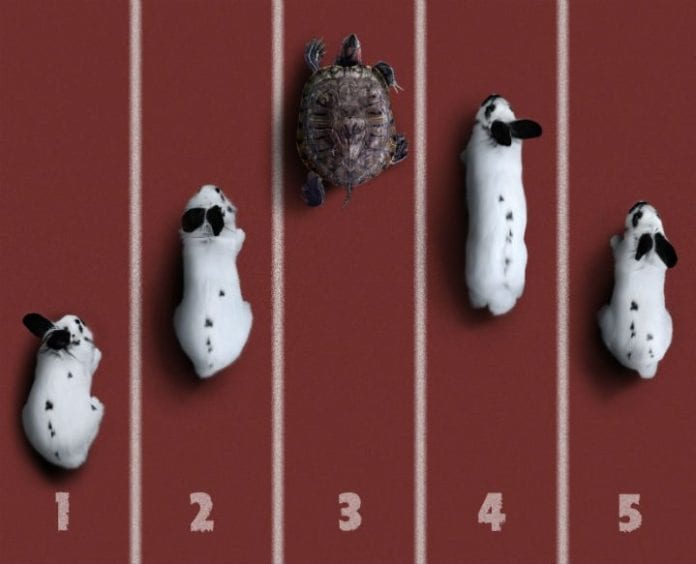

The domestic mobile market may have experienced a minor trembler over the past several weeks as reports indicate that the No. 3 and No. 4 operators in terms of customer base may have changed.

Sprint and T-Mobile US earlier this year announced their latest quarterly results showing that No. 4 T-Mobile US managed to add more than twice the number of new connections to its network during the final three months of 2014 than No. 3 Sprint. Those results put the carriers’ self-reported customer bases at 55.9 million for Sprint and just over 55 million for T-Mobile US.

The results forced T-Mobile US CEO John Legere to alter his previous prediction that the carrier would surpass Sprint as the nation’s third-largest operator by the end of 2014.

However, published reports noted that in Sprint’s latest 10-Q filing with the Securities and Exchange Commission, the carrier claims there were approximately 1.7 million customers on its network through resale partners that had been inactive for at least six months. When taken into account, that would seem to alter the balance of power for the nation’s No. 3 spot.

Sprint noted in a CNet story that continuing to count customers past the six-month date is standard practice for the carrier, which Legere countered during T-Mobile US’ quarterly conference call.

“In Sprint’s filings, there’s an industry standard that between 60 and 90 days on [mobile virtual network operator] customers, if there’s no usage or revenue, we all turn them off. Between AT&T and Verizon, it’s at a 60- or 90-day,” said Legere. “That used to be the policy for Sprint. They actually changed their policy to 6 months. … So do the math.”

The accounting issue could become moot in the near future as T-Mobile US noted that through the first quarter of this year it was continuing to see positive porting ratios with Sprint similar to the 2.2-to-1 ratio from the final three months of 2014.

“Porting ratios have been in our favor vs. the competition for seven consecutive quarters, and it looks like we will continue to beat everyone on total postpaid phone adds as well,” said Legere in connection with the carrier’s Q4 results.

Sprint looks to be at least tempering the position swap, however, as the carrier’s nearly 1 million net connections added during the final quarter of 2014 was nearly double the previous quarter, showing potential strong momentum behind the carrier’s aggressive marketing efforts. Sprint also noted that its improving network quality was beginning to show dividends in terms of turning around voluntary churn, although its latest figures showed year-over-year increases in overall churn levels.

Bored? Why not follow me on Twitter

Photo copyright: / 123RF Stock Photo