Claudia Bacco, Managing Director – EMEA for RCR Wireless News, has spent her entire career in telecom, IT and security. Having experience as an operator, software and hardware vendor and as a well-known industry analyst, she has many opinions on the market. She’ll be sharing those opinions along with ongoing trend analysis for RCR Wireless News.

In two announcements today, Amdocs detailed how its Mobile Financial Services solution will allow its customers and partners to reach more of the unbanked and underbanked population of the world.

Amdocs has been in the mobile financial services market since 2001 and launched the first digital wallet service in 2004 with Globe GCash. With this legacy it has quite a bit to say on the topic of those without access to banking or choosing to not utilize the services they do have access to. Just to define the terms unbanked and underbanked, let’s turn to the World Bank. According to the World Bank, an unbanked individual is defined as a person who does not use or does not have access to commercial banking services. The underbanked are defined as those people or businesses that have poor access to mainstream financial services normally offered by retail banks. More specifically those who cannot physically get to a banking institution or the retail bank they have access to provides a limited subset of or even no retail services. So basically a cash in/cash out scenario.

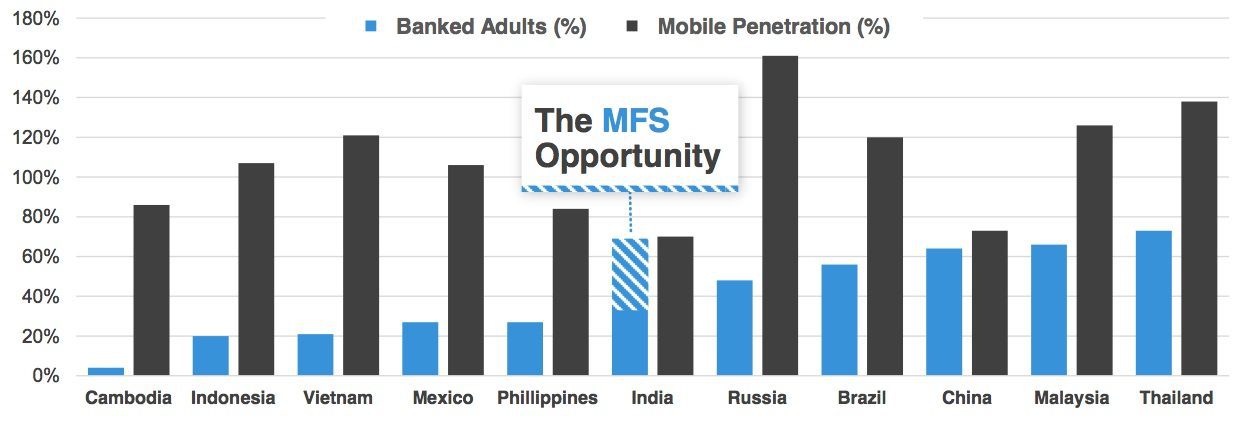

If you’re wondering how large this is issue is, it’s surprisingly large. Globally 2.5 billion people fall into the unbanked category, according to World Bank. Not all of them need financial services, but the statistics are still hard to imagine. Especially since 1.7 billion or almost 70% of these individuals have access to a mobile phone. The other surprise is that this is not only an issue in developing countries. It’s much easier to imagine this scenario in a region where the access to mobile phones or the Internet is a problem. Or areas where one would have to travel a long distance from a remote region to find a financial institution, but this also is an issue in developed countries – such as the United States.

Within the U.S. market there are estimated to be about 10 million unbanked and 25 million underbanked households. Of these individuals, 68% have a mobile phone and of those users 33% have smartphones. So why aren’t they banking? The top three reasons are high fees, a distrust for the financial institutions or not feeling as though they have enough income to warrant a bank account. Then there’s the age issue. What’s even more interesting is the view of the millennial market. According to a survey entitled the Millennial Disruption Index, banking is the area with the highest expectation for disruption in the coming years. There are some statistics in this survey that should put the financial services industry on high alert, but the one I want to repeat is the following – 73% would rather do their financial transactions through Google, Apple, Amazon, PayPal or Square then a nationwide banking institution. This survey is definitely worth taking a look at.

So how does Amdocs play a role in all of this? The first announcement of the day is related to a solution launch to enable mobile network operators, banks and other financial institutions to deliver more banking services via smartphone in an affordable fashion. Building on its March acquisition of Utiba, the new solution set will include:

- a single mobile wallet to virtually store and utilize financial assets

- increased ability to speed to market new financial services as they are developed

- integration of partner payments and settlements

- back-office integration with Amdocs’ financial services center of excellence for overall solution delivery and ongoing management if desired

- dedicated business accelerator program to help design and launch new offerings.

The second announcement relates to a launch in rural India in cooperation with Triotech, State Bank of India and BSNL. The solution will provide rural customers with access to secure mobile banking services including money transfers, bill payments and airtime recharges on their BSNL account. Over time, other merchants will enable easy payment and top-up services. These could include companies such as utility providers and employers.

Amdocs shared some statistics related to the market in India to help illustrate the size of the opportunity. Sixty-five percent of the population is unbanked, although 70% of the population has a mobile device. Only 2% use credit cards and when a loan is needed, 20% turn to family and friends instead of a financial institution. Seems like a lot of options could be launched in this type of market.

What’s so interesting about these types of announcements is the disruption sure to come in mobile payments. There’s been talk for a few years as to whether we will see mobile operators enabling payments and becoming financial institutions or even “banks” in the future. Although market entrants such as Google, Apple, etc. may have beat them to the starting gate, announcements such as this show there are still many opportunities left for the taking.