Software is becoming an increasingly important part of telecommunication networks and deployments as both wired and wireless carriers look to add functionality to operations while increasing simplicity and reducing costs. RCR Wireless News is keeping an eye on recent developments through its weekly “Software” wrap up.

—Hitachi Communication Technologies America launched its MME/SGSN on VMware’s VSphere platform that is able to run on commercial “off-the-shelf servers from multiple suppliers.” Hitachi notes that the move virtualizes its platform, allowing service providers to deploy network function virtualization applications in a cloud environment.

By offering the platform through VMware’s architecture, Hitachi claims virtualized service supports subscriber sessions that enable new LTE and machine-to-machine (M2M) devices; transactions processing that can manage the increase in 4G device transactions rates; and radio access network connectivity that exceeds “the fan-out required by the increasing deployment of small cells.”

Hitachi claims technical and market trials of the virtualized solution are in progress with “leading operators.”

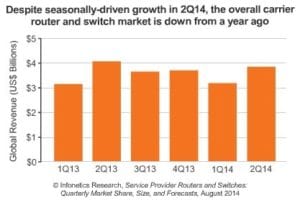

—The core router market managed to grow 11% sequentially during the second quarter, despite concerns that sales would be impacted by increased interest in network function virtualization and software-defined networking trends.

The results were posted by Infonetics Research, which noted that the overall router and switch market, including edge routers, surged 20% sequentially during the second quarter to $3.9 billion in sales. However, the research firm cautioned that longer-term growth would likely slow, citing a 4% year-over-year drop in sales.

“As we’ve been cautioning, service providers of all sizes are being more guarded with their router spending habits as massive network transformation goals involving [SDN] and [NFV] translate into specific activities and milestones,” explained Michael Howard, principal analyst for carrier networks and co-founder of Infonetics. “But this does not mean router and switch spending will tank or even take a sizeable downturn.”

As for top vendors in the space, Cisco Systems maintained its No. 1 position, with Alcatel-Lucent, Huawei and Juniper fighting over the No. 2 spot.

—Software-based security took a turn this week as August announced the initial availability of its Smart Lock that allows user to lock and unlock a deadbolt using their smartphone.

The “all-metal, whisper-quiet” deadbolt is designed to retrofit to compatible deadbolts and sells for $250. Once installed, users can activate the deadbolt using a downloadable application from smartphones running Apple’s iOS or Google’s Android operating systems.

August says the virtual key allows users to manage access to their home.

—A new report from cloud communications provider Voxbone claims that cloud contact center providers have experienced a 14% increase in call volume minute over the past six months. The company noted that due to the “in the cloud” nature of such call centers, they are able to scale to meet the demand as they are not “limited by the traditional boundaries of national phone networks.”

Further bolstering its argument for such an arrangement, Voxbone cited a recent IDC Research report that predicted spending for on-demand cloud contact centers in the United States will increase from $733.3 million in 2013 to $1.6 billion in 2018.

“Digital communications have dramatically changed the way that customers interact with companies, and customers now are using more channels than ever to communicate,” explained Melissa O’Brien, research analyst for IDC’s Worldwide Customer Care BPO Services Team. “Add in the increasing acceptance of services delivered via cloud computing and the opportunity for contact center services in the cloud accelerates. BPO providers, telcos, traditional communications systems providers, software companies and pure-play cloud contact center service providers have all seen the business opportunity to compete and partner in this contact center market and ecosystem. Clients of these businesses are impacted by the dynamic changes happening in customer communications that are pushing the customer experience toward the forefront. Many enterprises have found that using hosted or on-demand contact center solutions enables more flexibility and other benefits to help meet customer expectations. Also, companies are seeking to cut costs and focus more on core business activities, often viewing hosted and on-demand services as a way to reduce the capital expenditures of premise-based contact centers. Many enterprises are also seeking a way to scale up or down for seasonal needs or other business changes. By outsourcing contact center business processes and applications, enterprises are often able to achieve greater flexibility and quicker access to new channels as customers demand support on those channels.”

Make sure to check out the latest in telecom related software news at RCR Wireless News’ dedicated software page. Also, if you have telecom software news to share, please send it along to: [email protected].

Bored? Why not follow me on Twitter?

Software: Hitachi virtualizes MME/SGSN platform; router market impacted by NFV, SDN

ABOUT AUTHOR